In the realm of estate planning, the expertise of seasoned attorneys can serve as a guiding light through the intricate process of securing your legacy. As you navigate the complexities of wills, trusts, and asset distribution, having skilled professionals by your side can be invaluable.

These estate planning attorneys bring a wealth of knowledge and experience to the table, ensuring that every aspect of your estate plan is meticulously crafted to align with your wishes and protect your assets.

But what sets these legal experts apart? How can their insights and strategic approach truly empower your plan to withstand the test of time and changing circumstances?

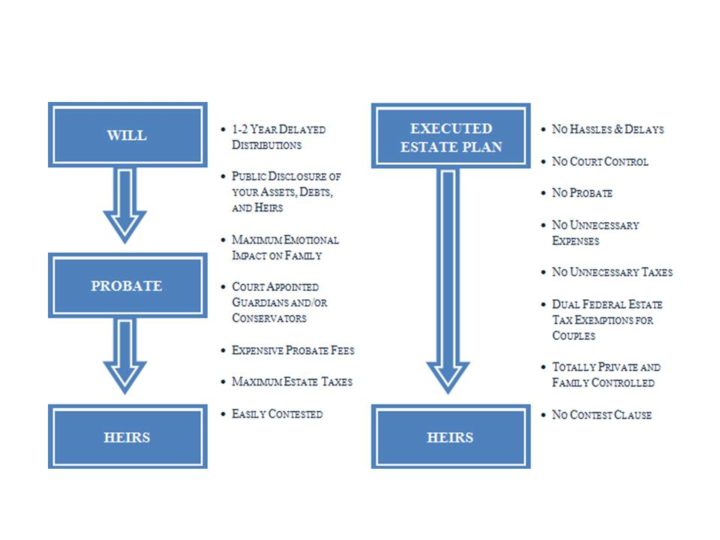

One significant advantage of enlisting the services of estate planning attorneys is their expertise in navigating complex legal processes efficiently and effectively. Estate planning involves intricate laws and regulations that can be overwhelming for individuals.

Attorneys specializing in this field possess a deep understanding of estate planning requirements, ensuring that all legal aspects are addressed accurately. They can provide tailored solutions based on individual circumstances, guiding clients through the complexities of wills, trusts, probate, and more.

By leveraging their knowledge and experience, estate planning attorneys help clients avoid costly mistakes and streamline the planning process. Their adept handling of legal intricacies not only saves time but also offers peace of mind knowing that one's estate affairs are in capable hands.

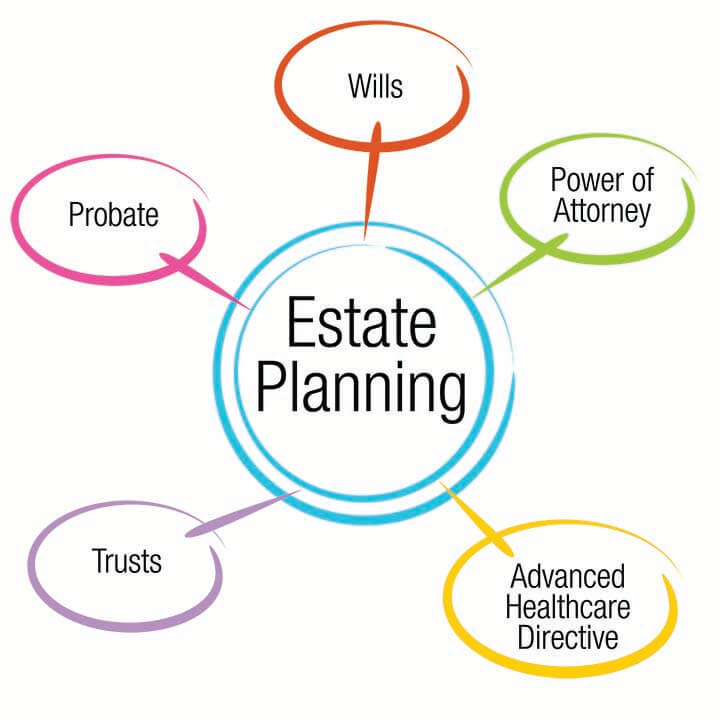

When engaging with estate planning services, it is essential to comprehend the range of legal assistance and strategic planning they offer to ensure the efficient management and distribution of assets according to one's wishes.

Estate planning services encompass a variety of key components, including will drafting, establishing trusts, setting up powers of attorney, healthcare directives, and addressing tax implications. Experienced estate planning attorneys guide individuals in making informed decisions to protect their assets and provide for their loved ones.

These services also involve evaluating current financial situations, potential future needs, and creating a comprehensive plan that aligns with individual goals. By understanding the depth and breadth of estate planning services, individuals can proactively address their estate needs and secure their legacy.

Regularly updating your estate plan is crucial to ensure that it remains aligned with your current circumstances and goals. As life unfolds, changes in relationships, finances, and laws may impact the effectiveness of your existing plan.

By scheduling periodic reviews with your estate planning attorney, you can address any necessary adjustments promptly. Updating your plan allows you to accommodate major life events such as marriages, divorces, births, or deaths within your family.

Additionally, staying informed about evolving tax laws and regulations can help optimize your estate plan for tax efficiency. Proactively revisiting and modifying your estate plan ensures that it continues to reflect your wishes accurately and provides peace of mind for you and your loved ones.

To effectively reduce tax liabilities within your estate plan, strategic consideration of financial structures and legal mechanisms is essential. By utilizing tools such as trusts, charitable donations, and gifting strategies, experienced estate planning attorneys can help minimize the tax burdens on your estate.

Trusts, such as irrevocable life insurance trusts or charitable remainder trusts, can offer tax advantages by removing assets from your taxable estate. Additionally, making charitable donations during your lifetime or including charitable bequests in your will can help lower estate taxes.

Implementing a well-thought-out gifting strategy can also reduce the size of your taxable estate over time. With the guidance of knowledgeable professionals, you can proactively mitigate tax liabilities and maximize the distribution of your assets to your intended beneficiaries.

In the realm of estate planning, beyond mitigating tax liabilities effectively, ensuring the safeguarding of your healthcare wishes holds significant importance for a comprehensive and well-rounded plan.

Advanced directives such as living wills and healthcare proxies allow individuals to outline their preferences regarding medical treatment and appoint trusted individuals to make healthcare decisions on their behalf if they become incapacitated.

By clearly documenting your healthcare wishes, you provide guidance to your loved ones and healthcare providers, ensuring that your desires are respected even if you are unable to communicate them yourself. Including provisions for healthcare wishes in your estate plan can offer peace of mind and help avoid potential conflicts or uncertainties during critical medical situations.

With meticulous planning and strategic foresight, estate planning attorneys facilitate the seamless transfer of wealth from one generation to the next, ensuring financial security and continuity for your beneficiaries.

By leveraging various legal tools such as wills, trusts, and powers of attorney, these attorneys help individuals navigate complex tax laws and regulations to minimize tax liabilities and maximize the value of the estate passed down to heirs.

Moreover, they can assist in establishing structures like family partnerships or charitable foundations to preserve wealth and foster a legacy of giving. Through careful consideration of each client's unique circumstances and goals, estate planning attorneys play a vital role in safeguarding assets and orchestrating a smooth transition of wealth for future generations.

Estate planning attorneys can indeed assist in creating special needs trusts for disabled family members. These trusts are crucial for providing financial support while preserving eligibility for government benefits. Attorneys with expertise in this area can help navigate the complex legal requirements, ensure proper funding, and appoint appropriate trustees. By establishing a special needs trust, families can secure the future well-being of their disabled loved ones in a structured and legally sound manner.

Establishing a charitable trust in your estate planning offers several benefits. It allows you to support causes you are passionate about even after you're gone, provides potential tax advantages, and can help create a lasting legacy for your family. By setting up a charitable trust, you can ensure that your assets are used to make a positive impact in the world while also potentially reducing estate taxes.

Estate planning attorneys approach planning for incapacity and long-term care needs by developing comprehensive strategies that include powers of attorney, healthcare directives, trusts, and insurance products. These professionals work closely with clients to understand their unique circumstances, preferences, and concerns, ensuring that their wishes are clearly documented and legally enforceable. By addressing these critical aspects of estate planning, individuals can better prepare for potential incapacity and ensure their long-term care needs are met according to their desires.