Engaging an estate planning attorney is a prudent step in safeguarding one's legacy, as their expertise helps individuals navigate the intricacies of estate planning while avoiding common pitfalls. Many people underestimate the importance of accurate documentation, tax implications, and the necessity of updating their plans.

Additionally, misunderstandings surrounding asset distribution and healthcare directives can lead to significant complications. The ramifications of overlooking state-specific laws can be profound.

Understanding these common mistakes and the value an attorney brings can illuminate the critical steps necessary for effective estate planning. What specific oversights might be lurking in your current approach?

One of the most critical pitfalls in estate planning is the prevalence of incomplete or incorrect documentation. Proper estate planning necessitates a thorough understanding of legal requirements and the specific needs of the individual.

Failing to accurately document assets, beneficiaries, or intended distributions can lead to disputes and unintended consequences after one's passing. Additionally, using outdated forms or neglecting to update documents following significant life changes, such as marriage or divorce, can render an estate plan ineffective.

Consulting an estate planning attorney ensures that all documentation is precise, comprehensive, and compliant with current laws. This professional guidance not only minimizes the risk of errors but also provides peace of mind, knowing that one's estate will be managed according to their wishes.

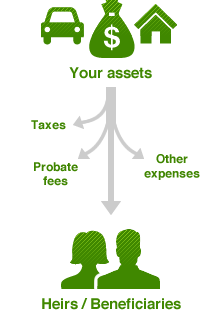

Ignoring tax implications during estate planning can lead to significant financial repercussions for both the estate and its beneficiaries. Proper tax planning is essential to minimize estate taxes, inheritance taxes, and capital gains taxes that may arise upon the transfer of assets.

Without a thorough understanding of applicable tax laws, individuals may inadvertently create a tax burden that diminishes the estate's value. Additionally, failing to consider tax implications can affect the distribution strategy, potentially disadvantaging certain beneficiaries.

Consulting an estate planning attorney ensures that tax-efficient strategies are implemented, such as utilizing trusts or gifting strategies, to protect wealth and enhance the financial legacy. Informed planning can preserve assets and maximize benefits for heirs, making tax considerations a vital component of any estate plan.

Estate plans should not be viewed as static documents; they require regular review and updates to reflect changes in personal circumstances, laws, and financial situations. Life events such as marriage, divorce, the birth of children, or the death of a beneficiary can significantly impact the effectiveness of an estate plan.

Additionally, changes in tax laws or regulations may necessitate adjustments to ensure compliance and optimize benefits. Failing to update an estate plan can result in unintended consequences, such as assets being distributed contrary to the individual's wishes or increased tax liabilities.

By consulting an estate planning attorney, individuals can ensure their plans remain relevant and effective, ultimately safeguarding their legacy and providing peace of mind for themselves and their loved ones.

Many individuals overlook the complexities involved in asset distribution, leading to significant misunderstandings about how their assets will be allocated after their passing. One common misconception is that simply naming beneficiaries on accounts guarantees a smooth transfer.

However, various factors, such as debts, taxes, and state laws, can impact distribution. Additionally, individuals often fail to consider the implications of joint ownership or the potential for disputes among heirs.

Without clear instructions in a will or trust, the distribution process may result in unintended consequences, causing stress and conflict among family members. Consulting an estate planning attorney ensures that individuals fully understand their options and the legal ramifications, ultimately facilitating a more equitable and efficient distribution of assets.

Often, individuals neglect to address critical healthcare decisions when planning their estates, which can lead to confusion and distress for both themselves and their loved ones. Essential documents, such as advance healthcare directives and medical power of attorney, are vital for ensuring that one's healthcare preferences are honored in case of incapacitation.

Without these legal instruments, family members may face difficult decisions without guidance, potentially resulting in disagreements or choices that do not reflect the individual's wishes. Furthermore, specifying preferences regarding life-sustaining treatments and end-of-life care can provide clarity and peace of mind.

Consulting an estate planning attorney can help individuals navigate these complex issues, ensuring that their healthcare decisions are clearly articulated and legally binding, thereby safeguarding their dignity and autonomy.

A significant oversight in estate planning is neglecting to consider the specific laws and regulations of one's state. Each state has unique statutes governing wills, trusts, and probate procedures, which can significantly affect the distribution of assets.

For instance, some states require a witness signature for a valid will, while others may allow holographic (handwritten) wills. Furthermore, laws concerning tax implications and estate administration can vary greatly.

Failing to account for these differences may result in unintended consequences, such as a will being deemed invalid or assets being subjected to unnecessary taxes. Consulting an estate planning attorney ensures that your plan complies with state laws, providing peace of mind that your wishes will be honored and your heirs protected.

Estate planning can help protect assets from creditors or legal claims by utilizing various legal tools. Strategies like trusts, gifting, and insurance can shield assets from potential threats. However, the effectiveness of these protections can vary based on individual circumstances and the specific legal frameworks in place. Consulting with experienced estate planning attorneys can help tailor a plan to best safeguard assets and navigate potential risks.

Estate planning attorneys can indeed assist in setting up trusts for various specific purposes beyond asset distribution. Trusts can be tailored to achieve specific goals like providing for a loved one with special needs, supporting charitable causes, or protecting assets from creditors. By understanding a client's unique circumstances and objectives, skilled estate planning attorneys can create customized trust structures that align with their clients' wishes and offer the desired level of protection and flexibility.

When choosing beneficiaries for an estate plan, common mistakes include failing to update beneficiaries after major life events, such as marriage, divorce, or the birth of children. Another error is not considering the potential impact of taxes on the assets being passed down. Additionally, choosing minors as beneficiaries without setting up a trust to manage the assets until they reach adulthood can lead to complications. Consulting with an estate planning attorney can help avoid these pitfalls.