Selecting the right broker is a fundamental step in unlocking your trading potential in the Forex market. A broker not only acts as an intermediary but also significantly influences your trading experience through their platform capabilities, fee structures, and the support they provide.

With a plethora of options available, understanding the essential features and evaluating broker credibility is critical for both novice and seasoned traders alike.

As you consider these factors, the question remains: what specific attributes should you prioritize to maximize your success in Forex trading?

Understanding forex brokers is essential for anyone looking to navigate the complexities of the foreign exchange market. Forex brokers serve as intermediaries between traders and the global currency market, facilitating the buying and selling of currency pairs.

They provide access to trading platforms, market analysis, and various tools to enhance trading strategies. Brokers can be categorized into two main types: market makers and ECN (Electronic Communication Network) brokers, each offering different pricing structures and execution methods.

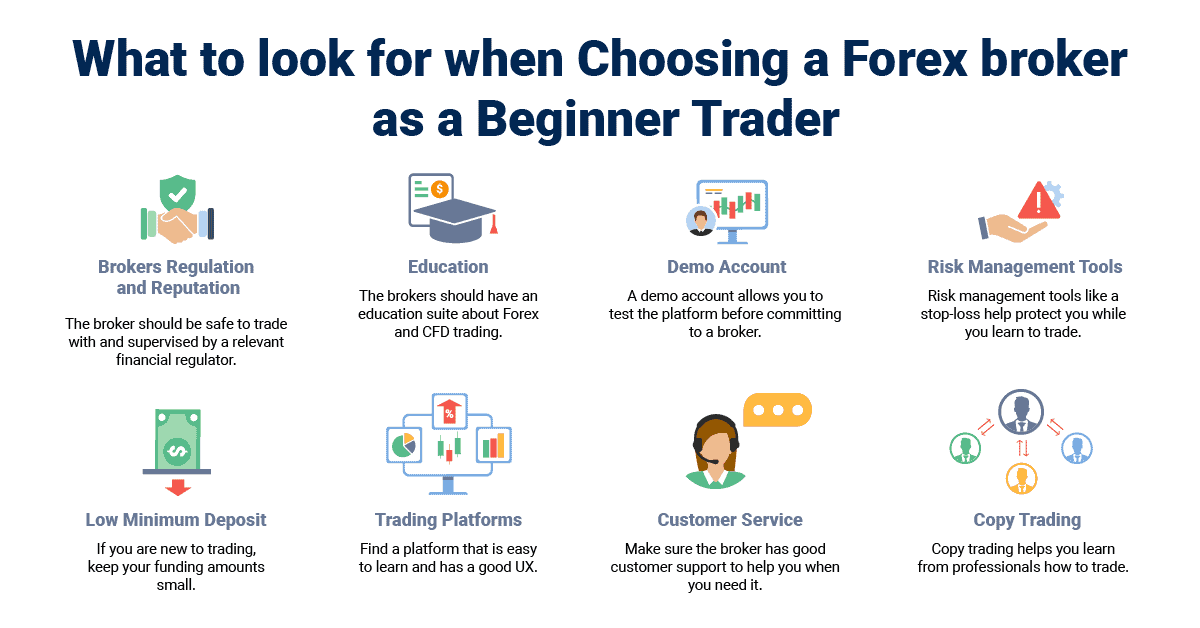

It is crucial to assess the broker's regulatory status, as this ensures compliance with industry standards and safeguards traders' funds. Additionally, understanding the broker's role can help traders make informed decisions, optimize their trading experience, and reduce the risks associated with currency trading.

When selecting a forex broker, what key features should traders prioritize to ensure a successful trading experience? First, consider the broker's regulatory compliance, as this ensures a level of security for your funds and transparency in operations.

Next, assess the trading platform's usability and functionality, including charting tools, order types, and execution speed, which are crucial for effective trading. Additionally, examine the range of currency pairs offered, as a diverse selection can enhance trading strategies.

Finally, customer support is essential; responsive and knowledgeable assistance can help resolve issues quickly, enhancing the overall trading experience. Selecting a broker with these features can significantly impact your trading success.

Numerous types of forex brokers exist, each catering to different trading styles and preferences. The primary categories include market makers, ECN (Electronic Communication Network) brokers, and STP (Straight Through Processing) brokers.

Market makers provide liquidity by setting their own bid and ask prices, often benefiting retail traders. ECN brokers facilitate direct market access, allowing traders to interact with other market participants, which can lead to tighter spreads. STP brokers, on the other hand, route orders directly to liquidity providers, minimizing the latency and potential conflicts of interest.

Each type has its own advantages and disadvantages, and understanding these distinctions is crucial for traders looking to align their broker choice with their trading strategy and goals.

Selecting the right type of forex broker is only the first step; evaluating their credibility is equally important for ensuring a secure and reliable trading experience. Begin by checking the broker's regulatory status with reputable financial authorities, as this provides a layer of security and oversight.

Look for brokers that are members of compensation schemes, offering additional protection for your funds. Additionally, consider their trading history and reputation within the trading community. Client reviews and testimonials can offer insight into the broker's reliability and service quality.

Furthermore, assess the transparency of their operations, including their policies on withdrawals and deposits. A credible broker fosters trust and ensures that traders can operate in a secure trading environment.

Comparing fee structures among forex brokers is essential for traders looking to maximize their profitability. Different brokers offer various fee models, including spreads, commissions, and overnight financing costs. Spreads can be fixed or variable, impacting the cost of executing trades.

While some brokers may advertise low spreads, hidden commissions can significantly increase overall costs. Additionally, understanding overnight fees, or swaps, is crucial for traders who hold positions beyond one trading day.

It is vital to analyze not only the explicit fees but also any potential hidden charges that may arise. By thoroughly comparing these fee structures, traders can select a broker that aligns with their trading strategy and minimizes costs, ultimately enhancing their overall trading performance.

Educational resources play a pivotal role in a trader's journey toward success in forex trading. Brokers that prioritize education provide a wealth of materials, including webinars, e-books, tutorials, and market analyses, which are essential for both novice and experienced traders.

These resources empower traders to understand market dynamics, technical analysis, and risk management strategies. Furthermore, interactive platforms and demo accounts allow traders to practice their skills in a risk-free environment, fostering confidence and competence.

Engaging with educational content not only enhances knowledge but also cultivates a disciplined approach to trading. By utilizing these resources effectively, traders can refine their strategies, make informed decisions, and ultimately unlock their full trading potential in the competitive forex market.

Many brokers offer trading competitions and bonuses to incentivize their clients. These competitions often reward traders based on performance metrics such as profitability or trading volume, fostering a competitive spirit among participants. Bonuses may include deposit matches or no-deposit incentives, allowing traders to enhance their capital. It is essential for traders to review the specific terms and conditions associated with these offerings, as they can vary significantly between different brokerages.

Yes, you can switch brokers after starting trading. Many traders choose to do so for various reasons, such as seeking better trading conditions, lower fees, or enhanced customer service. However, it is essential to consider the implications of transferring funds and positions, as well as the potential impact on your trading strategy. Ensure that you familiarize yourself with the new broker's terms and conditions before making the transition to avoid any unexpected challenges.

Utilizing an unregulated broker presents several significant risks. Primarily, such brokers lack oversight, increasing the likelihood of fraudulent practices, including the misappropriation of funds and manipulation of trade execution. Additionally, traders have limited recourse in case of disputes, as unregulated entities are not subject to industry standards or consumer protection laws. This absence of regulatory compliance can lead to compromised security and a heightened risk of substantial financial loss for investors.