In today's fast-paced business environment, effective expense management is essential for both individuals and organizations. An efficient mileage tracker can significantly simplify this process, offering solutions that automate the recording of travel distances and associated costs.

By utilizing advanced features such as GPS integration and automatic trip detection, these tools not only reduce human error but can also enhance compliance with tax regulations.

However, the true potential of a mileage tracker extends beyond mere tracking-understanding its integration with broader expense management systems could transform your financial operations in unexpected ways.

Mileage tracking is an essential practice for both individuals and businesses aiming to manage travel expenses effectively. It involves recording the distance traveled for business-related purposes, ensuring accurate reimbursement and tax deduction processes.

This practice can encompass various methods, such as manual logbooks, spreadsheets, or dedicated mobile applications. Proper mileage tracking requires attention to detail, including the starting and ending odometer readings, the purpose of each trip, and any relevant dates.

Accurate records not only facilitate compliance with tax regulations but also provide valuable insights into travel patterns and costs. By understanding the principles of mileage tracking, users can streamline their expense management, ensuring financial accountability and optimizing resource allocation.

Effective mileage tracking offers numerous advantages that extend beyond mere record-keeping. By systematically documenting travel for business purposes, organizations can ensure compliance with tax regulations and maximize deductions, ultimately reducing overall tax liability.

Additionally, an efficient mileage tracker enhances accuracy, minimizing human error associated with manual logs. This leads to reliable reporting, which can be crucial during audits. Furthermore, real-time tracking allows businesses to monitor employee travel, promoting accountability and optimizing resource allocation.

Implementing a mileage tracker can also streamline reimbursement processes, enhancing employee satisfaction by ensuring timely compensation for business-related travel expenses. Overall, leveraging a mileage tracker contributes to improved financial management and operational efficiency, making it an essential tool in expense management strategies.

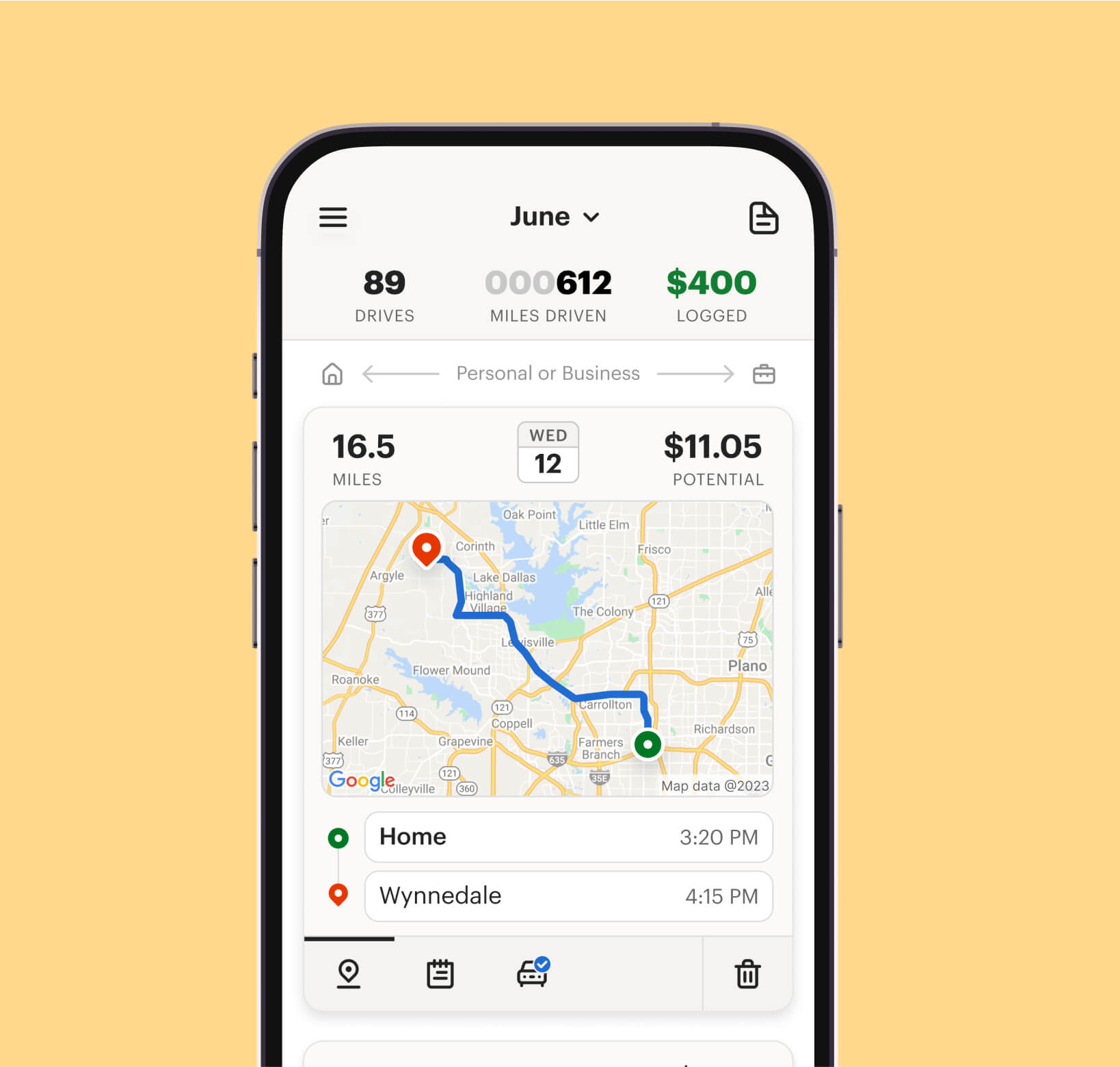

When selecting a mileage tracking solution, key features play a pivotal role in ensuring its effectiveness. Firstly, automatic tracking capabilities can significantly enhance accuracy by logging trips without manual input. Additionally, look for GPS integration, which allows for precise route mapping and distance calculation.

A user-friendly interface is crucial for ease of use, enabling quick access to essential data. Furthermore, customizable reporting options can assist in generating tailored expense reports for tax purposes or reimbursement.

Lastly, ensure that the app offers cloud storage for data security and accessibility across multiple devices. By prioritizing these features, businesses can effectively streamline their expense management processes and ensure compliance with financial regulations.

For those seeking reliable mileage tracking solutions, several popular apps stand out in the market. One of the most widely used is MileIQ, which offers automatic trip detection and detailed reporting features. Another strong contender is Everlance, known for its user-friendly interface and versatile expense tracking capabilities.

TripLog is also notable, providing robust reporting tools and integration with various accounting software. Additionally, Google Maps can be utilized creatively for mileage tracking, though it lacks dedicated features.

Lastly, Stride Tax is tailored for freelancers, combining mileage tracking with tax deduction insights. Each of these applications caters to different user needs, ensuring that individuals and businesses alike can simplify their mileage management effectively.

Integrating mileage tracking apps with expense management tools can significantly enhance the efficiency of financial reporting and tax preparation. This integration allows for seamless data transfer between mileage records and expense reports, eliminating the need for manual entry and reducing the likelihood of errors.

Users can automatically categorize trips, ensuring that every mile driven for business purposes is accounted for and accurately reflected in expense reports. Additionally, having a centralized platform simplifies the auditing process, making it easier to provide necessary documentation during tax season.

By automating these tasks, businesses can save valuable time, allowing employees to focus on core activities rather than manual expense management. Ultimately, this integration fosters greater financial transparency and accuracy in reporting.

Effective mileage tracking is essential for accurate expense reporting and tax compliance. To ensure effective tracking, start by consistently recording your mileage using a reliable tool or app. Capture essential details such as date, purpose, and starting and ending odometer readings.

Establish a routine, documenting trips immediately after they occur to minimize errors and omissions. Categorize your mileage based on business and personal use to streamline reporting. Integrate your mileage tracker with expense management software for seamless data synchronization.

Additionally, periodically review your recorded mileage to ensure accuracy and completeness. Finally, always stay informed about any changes in tax regulations that may impact your mileage claims, ensuring compliance and maximizing the benefits of your tracking efforts.

Updating your mileage log regularly is crucial for accuracy and compliance. It is recommended to update your log at least weekly to ensure that all trips are documented promptly. This frequency helps capture details such as purpose, distance, and destinations while minimizing the risk of forgetting essential information. Additionally, maintaining a consistent schedule supports better organization and facilitates easier reporting, whether for personal records or potential tax-related purposes.

Mileage tracking can significantly influence insurance premiums, as many insurers consider driving habits and annual mileage when determining rates. Regularly documenting mileage allows insurers to assess risk more accurately, potentially leading to lower premiums for low-mileage drivers. Conversely, high mileage may indicate increased risk, resulting in higher premiums. Therefore, maintaining detailed records of mileage can provide valuable insights that may ultimately benefit policyholders in negotiating better insurance rates.

Commuting mileage, which refers to the travel from your home to your primary workplace, is generally not deductible for tax purposes. The IRS considers this personal commuting, and expenses incurred during this travel do not qualify for deductions. However, if you use your vehicle for business purposes outside of your regular commute, those specific miles can be deductible. It is essential to maintain accurate records to substantiate any business-related mileage claims.